Start-ups: India

(→2015) |

(→2016) |

||

| Line 150: | Line 150: | ||

R Chandrashekhar, president, Nasscom, said, “The emergence of unicorns (startups with a valuation of $1 billion or more) and the big exits have created a lot of confidence in the ecosystem. Startups are now creating innovative technology solutions that are addressing social problems.“ | R Chandrashekhar, president, Nasscom, said, “The emergence of unicorns (startups with a valuation of $1 billion or more) and the big exits have created a lot of confidence in the ecosystem. Startups are now creating innovative technology solutions that are addressing social problems.“ | ||

| − | = | + | |

| + | =Steps to encourage start-ups= | ||

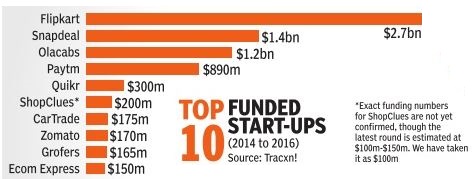

[[File: Top 10 funded start-ups (2014 to 2016).jpg| Top 10 funded start-ups (2014 to 2016); Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=16_01_2016_033_016_001&type=P&artUrl=START-UP-NATION-16012016033016&eid=31808 ''The Times of India''], January 16, 2016|frame|500px]] | [[File: Top 10 funded start-ups (2014 to 2016).jpg| Top 10 funded start-ups (2014 to 2016); Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=16_01_2016_033_016_001&type=P&artUrl=START-UP-NATION-16012016033016&eid=31808 ''The Times of India''], January 16, 2016|frame|500px]] | ||

| − | ==National Student Start-up Policy== | + | ==2016: National Student Start-up Policy== |

[http://www.thehindubusinessline.com/todays-paper/tp-news/president-releases-aicte-policy-on-startups/article9383714.ece ''The Hindu Business Line''], November 25, 2016 | [http://www.thehindubusinessline.com/todays-paper/tp-news/president-releases-aicte-policy-on-startups/article9383714.ece ''The Hindu Business Line''], November 25, 2016 | ||

Revision as of 07:22, 30 January 2017

This is a collection of articles archived for the excellence of their content. |

Contents |

2015-16: 36% increase

The Times of India, May 13 2016

Startup rush: No. of new pvt cos up 36% in 2015-16

Lubna Kably

The burgeoning startup ecosystem seems to have boosted growth of non-government or private companies. During the year 2015-16, as many as 60,414 private companies with an aggregate authorized capital of Rs 10,845 crore were registered (statistics are up to December 31) -a hike of 36% over the previous corresponding period (see table). Experts say that a private company is the best legal entity form for incorporation of a startup, especially one which is growth-oriented.

At the same time, traditional businessmen functioning as solo proprietors continued to show their preference for one-person companies (OPCs), with registrations almost doubling to 2,761during the financial year 2015-16 (up to December 31), according to the latest annual report released by the Ministry of Corporate Affairs (MCA). The collective authorized capital of the newly regis tered OPCs was nearly Rs 67 crore. The business services sector dominated, with 58% of OPCs falling in this category .While OPCs enable a single proprietor to corporatize his business, it isn't an ideal entity for startups claim experts.

Lionel Charles, CEO of Indiafilings.com, says, “Venture capitalists (VCs) do not recommend OPCs as the shares can be held by one person only and equity funding by VCs isn't feasible. An OPC is also required to mandatorily convert into a private company once its turnover exceeds Rs 2 crore or share capital exceeds Rs 50 lakh.“

Harish H V , partner at Grant Thornton, says, “Typically, startups have more than one founder. They also aim at equity infusion from angel investors and VCs. Esops are also granted to employees who ultimately hold a stake in the startup. This makes a private company form more suitable. Moreover, a minimum share capital of Rs 1 lakh is no longer required for incorporation, adding to their popularity .“

Government officials are of the view that the current year will see a further increase in the number of registrations of private companies in the backdrop of the `Startup India' programme. Recently , the govern ment carved out a separate definition for startups and offered various sops, including a tax holiday .

Eligible startups, subject to meeting certain conditions, are entitled to a tax holiday for a block of three out of the initial five years. To claim eligibility, the company must be incorporated between April 1, 2016 up to March 31, 2019, its total turnover must not exceed Rs 25 crore in any financial year and it must have obtained a certificate of eligible business from the Inter-Ministerial Board.

An amendment to the Finance Bill added limited liability partnership (LLP) in the definition of the term `startup'. LLPs are a hybrid model which provides personal immunity to the partners and offers a corporate structure. In India, professional services companies have largely adopted the LLP structure. However, for startups, especially those looking at VC funding, an LLP structure in not ideal in the long run.

Funding

2014, 2015: Funding deals

The Times of India, November 14, 2015

Though there's much hullabaloo about some startups retrenching employees and struggling to raise fresh rounds, data shows that many more funding deals are happening now than earlier in 2015 or, indeed in 2014. However, the cheque sizes are shrinking, indicating that investors want their firms to be more careful about their spends. In August- Oct 2015, there was an average of 53 funding deals a month, compared to 43 transactions in the first three months of 2015. In the first 10 months of 2014, there was an average of 24 deals a month, shows data from Tracxn, a startup data collection and analysis firm. The deals include startups that have been funded for the first time and funded companies getting subsequent rounds of investments. The overall number of deals this year, till October, stands at 494, compared to just 237 during the same period last year.

GSF, one of the country's most successful accelerators, said that seed rounds and Series A deals were flowing thick and fast. It saw three startups from its current batch getting Series A funding last month. It expects to announce another four to five deals by the end of this year for which term sheets have already signed. “I don't see any slowdown at seed stage or Series A stage for quality companies. Despite all the noise about a slowdown, I will go by data which shows the ecosystem is robust,“ said Rajesh Sawhney , founder of GSF. He, however, said there were valuation concerns that were resulting in slowdown in funding at later stages. For the startup ecosystem, Sawhney sees the base of the pyramid as being more important and the numbers indicate it is only getting stronger.

Vani Kola, founder and of Kalaari Capital, too, said Kalaari was continuing to see the same pace of investments as previously .

However, Aashish Bhinde, executive director (digital media and technology) at Avendus Capital, a leading investment bank in India, said the number of deals at the angel, seed or even Series A do not matter if the venture cannot raise subsequent rounds of funding. But he noted that markets have a tendency to overdo bullishness and bearishness and compared the situation to that in 2012-13 when investments came down after a big year in 2011.

One sign of growing cautiousness even in early stage funding can be seen in the deal sizes. The average value of a deal has dropped from $8 million in the first quarter of this year to $6 million in the latest quarter (excluding deals above $100 million). “Venture capital investors are becoming wary of the cash burn rate of startups,“ said Sawhney .

The MD of a major venture capital firm, who did not want to be named, said VCs were putting more effort into trying to understand every startup's business.

2015: Alumni of prestigious institutes get more funding

Anand J &ShilpaPhadnis

How the new caste system - FILTERS FUNDING CHOICES

Startup research firm Tracxn finds that 37% of the 3,373 startups founded in 2015 has been founded by alumni of at least one of the following prestigious institutes -IIT, IIM, BITS, and NIT (National Institutes of Technology). But as much as 67% of the $7 billion of funding raised in 2015 has gone to these startups.

Similarly, only 13% of the registered startups on online deal-making platform LetsVentureis founded by what it calls Ivy League founders -those from IIT, IIM, BITS, Indian School of Business (ISB), Oxford, Cambridge, and US Ivy League colleges. But these ventures ac count for 27% of the funded ventures, and 34% of total funding. Sutanu Banerjee did a degree in Chinese language from the Jawaharlal Nehru University (JNU) and has been running the New Delhi-based travel organizer Prakriti Inbound profitably for the past 15 years. He recently decided to raise some private funds to expand.

2016: Funding drops 50% from levels of 2015

Funding for startups almost halved this year, down to $3.8 billion compared to $7.6 billion in 2015, as risk investor pushed back with caution after two years of unprecedented exuberance.

The funding crunch impacted the overall ecosystem with the number of startups founded this year going down dramatically , data from startup tracking firm Tracxn showed.More than 9,462 startups (including non-technology startups) were founded in 2015, compared to 3,029 in 2016, according to Tracxn data.

Sluggishness in funding has been felt globally with some of the high-flying startups seeing their valuation being cut as sentiments around technology financing took a hit last year.

The number of startups that shut shop rose to 212 from 144 last year. However, the number of funding deals stood almost the same at 1,031compared to 1,024 last year.

Padmaja Ruparel, president at Indian Angel Network (IAN) attributed the decline this year to the lack of big fund raising by the unicorns. IAN was the most active investor this year with 36 funding rounds. “There was a lot of hype, last year, which has subsided a bit. We have seen a lot more committed entrepreneurs this year,“ Ruparel said.

The big startups that raised multiple rounds of funding last year like Flipkart, Quikr, and Grofers did not raise fresh capital in 2016. Among the top ten technology deals were the Ibibo Group and Makemytrip merger, Yatra (acquired by Nasdaqlisted Terrapin for $218 million), and fund raising by Bookmyshow and Hike.

While overall funding was weak, flow of early-stage deals did not see a slowdown. For IAN, the average funding round in 2016 has remained the same as 2015 at around Rs 2.5 crore, Ruparel said. While last year, they received 6,000 applications, this year IAN received 7,500 applications. “We have seen a wider spectrum of startups coming up, with a sharper focus on top and bottom line.“

All the major venture capital funds, which are flush with dry powder, as they have together raised more than $2 billion to invest in Indian startups, took selective bets this year.New York-based Tiger Global, which was one of the most active funds last year with more than 30 investments, has almost retreated from India as it did not make any new investments this year.

As numerous startups struggled to remain afloat, M&A activity also rose marginally indicating that companies opted for consolidation to avoid shutting down.

2015, Indian start-ups in global setup

ii) In terms of the number of startups in a city, Bangalore is followed by Mumbai and Delhi.

iii) Delhi, Mumbai and Bangalore lead the whole world in the number companies focussed on business through mobile phones.

The Times of India

2015: Bengaluru has youngest entrepreneurs in world

The Times of India, Jul 29 2015

Shalina Pillai & Anand J

At average 28.5 yrs, Bengaluru has youngest entrepreneurs in world

Bangalore has the youngest startup ecosystem in the world, with the average founder's age at 28.5 years, according to a survey of the top 20 global startup ecosystems. In Silicon Valley , the world's largest startup hub, the average age is eight years older than in Bengaluru at 36.2 years. Kuala Lumpur comes closest to Bengaluru, at 30.5 years, followed by Sao Paulo, 31.7 years, and Berlin, 31.8%. Sydney has the highest average age among startup founders, at 40.3 years, according to The Startup Ecosystem report by San Francisco-based Compass, a research firm that provides global benchmarking tools.

Compass also finds that Bengaluru moved up four positions to rank 15 in 2015 among the top 20 startup ecosystems, advancing from rank 19 in the 2012 ranking. It was amongst those who made the biggest leaps. Others who made similar leaps were New York, Austin, Singapore, Berlin and Chicago. Silicon Valley retains the top spot in the survey that looks at performance, funding, market reach, talent, and startup experience.

There were only three cities Bengaluru, Singapore, and Sydney from Asia Pacific in the top 20. Many of the cities in the top 20 were US ones. New Delhi was not in the top 20, but was among the runners up, together with Kuala Lumpur, Hong Kong, and Jakarta in Asia Pacific.

Bengaluru saw the most growth in seed fund rounds over the last three years, with an annual average growth of 53%. It was followed by Sydney (33%) and Austin (30%). According to the report, which was compiled with the help of global startup database CrunchBase, Bengaluru has done well in the funding parameter with a rank of 6, just below Chicago.

2015: Indian ‘unicorns’

The Times of India, Oct 12 2015

Shilpa Phadnis & Shalina Pillai

5 of 8 Indian unicorns in B'luru

Bengaluru is the unicorn capital of the country .Building on its IT services legacy , the city has emerged as he tech entrepreneurial hub and plays host to five out of the eight homegrown unicorns -Flipkart, Ola, InMobi, Quikr and MuSigma. E-tailer Snapdeal, restaurant discovery startup Zomato and mobile wallet startup Paytm, the other three Indian unicorns, are based in New Delhi. Unicorn is a term popularized by venture investor Ai een Lee to describe startups hat are valued at $1billion or more. CB Insights data show here are 140 unicorns global y with a cumulative valua ion of $503 billion.

E-commerce biggie Flipkart, which raised nearly $2 billion last year, is at the top of he Indian pecking order, va ued at $15 billion, showed da ta from Wall Street Journal.Taxi-hailing startup Ola, which moved its headquarters from Mumbai to Bengaluru, is valued at $5 billion.Mobile advertising platform InMobi boasts of a valuation of $2.5 billion, while data analytics firm MuSigma and online classifieds service Quikr have recorded valuations of $1billion each.

The number of companies entering the unicorn ros ter has grown significantly globally, with taxi hailing app Uber leading the club with a valuation of over $50 billion.

“Bangalore's tech-first cul ture lends itself to its startups taking category leadership This has contributed to the ci ty having more homegrown Unicorns than other cities in India,“ said Sharad Sharma co-founder of software pro ducts think tank Ispirt.

Ravi Gururaj, chairman of Nasscom Product Council believes the city's early mo ver advantage meant that it became a natural choice for startups as the primary place of business. “Why do you rob a bank? Because that's where the money is,“ he said. “Why do unicorns grow in Bangalo re? Because that's where the nurturing ecosystem is..where you can discover ta lent, connect with investors hire from MNC R&D centres and large IT service compa nies, learn from other peer startups and enjoy great weather. All of that combined make Bangalore India's most attractive city for leading startups,“ he said.

Bengaluru is the bedrock of the country's $146-billion IT sector where global IT brands like Infosys and Wipro were built and that has kicked off this virtuous cycle. The rub-off effect is obvious. MNCs flocked in big numbers to set up R&D outposts to leverage its technology talent pool. The city houses 350 global captive centres (GICs), including Target and Shell, out of 1,000 GICs in India.

The density of engineering talent and linkages with the Silicon Valley have contributed to the startup success story . Take InMobi, dubbed as the Indian challenger to Google, for instance. The mobile advertising platform relocated from Mumbai to Bengaluru to hire the best-inclass engineering talent.

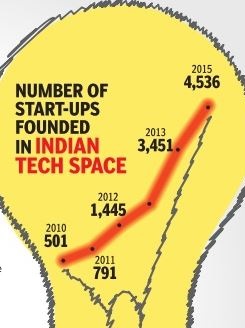

2015: Number of Indian startup No. 3 in world

The Times of India, Oct 14 2015

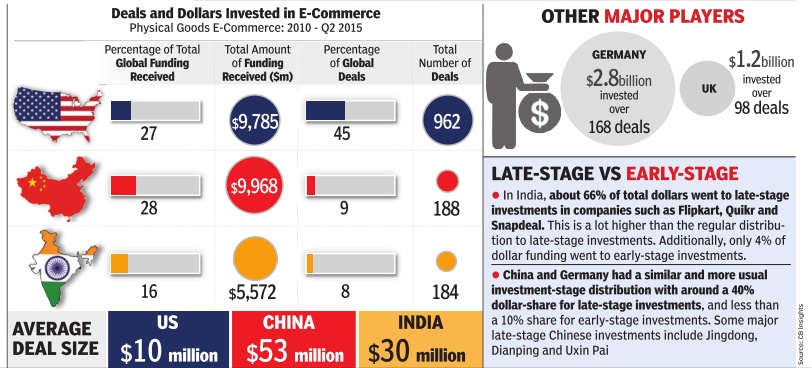

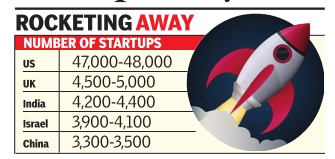

India bags No. 3 spot in world's startup ecosystem Fuelled by $100 million flowing into the country's startups every week, the number of startups founded in the country has grown by 40% in 2015 over the previous year, said Nasscom's latest report on the Indian startup ecosystem. India is the third biggest startup ecosystem with more than 4,200 founded and it is expected that the country will receive $6.5 billion in funding in 2015. The largest startup ecosystems are the US (47,000-48,000 startups) and UK (4,500-5,000). Israel and China follow India.

India saw 1,200 startups being born in 2015. Currently, three-four startups are born each day . The number of startups is projected to grow to around 12,000 by 2020. The startups now employ around 85,000 people directly .

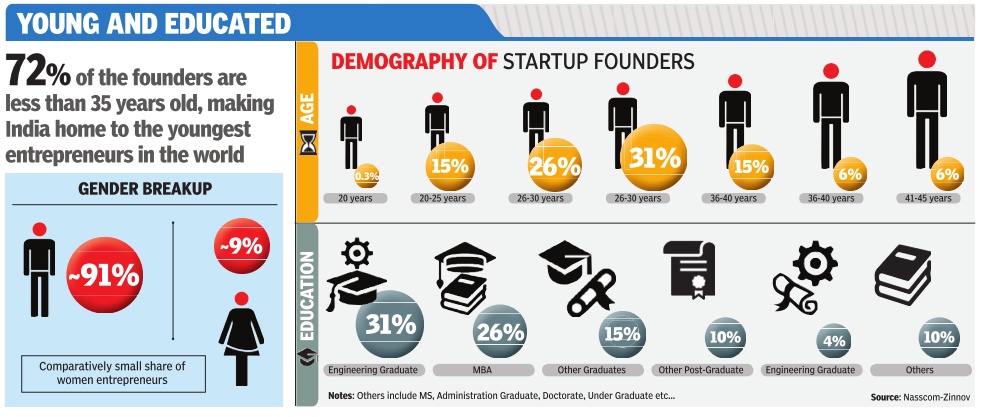

The report, launched in partnership with consulting firm Zinnov and Google, finds that 72% of the founders are less than 35 years old. The number of female entrepreneurs still constitutes only 9% of the entrepreneurs in the country , but the absolute number grew by 50% over the past year.

R Chandrashekhar, president, Nasscom, said, “The emergence of unicorns (startups with a valuation of $1 billion or more) and the big exits have created a lot of confidence in the ecosystem. Startups are now creating innovative technology solutions that are addressing social problems.“

Steps to encourage start-ups

2016: National Student Start-up Policy

The Hindu Business Line, November 25, 2016

To create 1,00,000 start-ups and one million new jobs by 2025, President Pranab Mukherjee has released a National Student Start-up Policy at Rashtrapati Bhavan, an official release said.

The policy, formulated by All India Council for Technical Education (AICTE) and which aims to make start-ups a mainstream career choice for students of all AICTE-approved colleges, was approved by the Executive Committee of AICTE in its 100th meeting held on June 28, 2016.

According to a release, the policy lays thrust on developing an “ideal entrepreneurial ecosystem and promoting strong inter-institutional partnerships among technical institutions” with the aim of guiding and grooming students to take up entrepreneurial careers and successfully launch start-ups.

The policy will also work towards re-orienting academic curriculum and pedagogy .