Natural Gas: India

(→Judicial judgments) |

|||

| Line 155: | Line 155: | ||

While the companies grapple with the conundrum, there is a renewed move in the government to strip them of 118 small producing discoveries – 113 of ONGC and 5 of OIL accounting for 10% of their output – for auctioning. Many of these operate through budget and infrastructure of larger fields and may not offer value proposition in isolation. Another concern is that wildcatters and small players have been known to damage reservoirs irretrievably in quest of making a quick buck. | While the companies grapple with the conundrum, there is a renewed move in the government to strip them of 118 small producing discoveries – 113 of ONGC and 5 of OIL accounting for 10% of their output – for auctioning. Many of these operate through budget and infrastructure of larger fields and may not offer value proposition in isolation. Another concern is that wildcatters and small players have been known to damage reservoirs irretrievably in quest of making a quick buck. | ||

| − | = | + | =See also= |

| − | + | [[Oil and Natural Gas Corporation (ONGC)]] | |

| − | [ | + | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

Revision as of 11:30, 29 November 2018

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

City Gas Distribution

2014-18

Dharmendra Pradhan, Gas-based economy fuels cleaner growth, November 22, 2018: The Times of India

From: Dharmendra Pradhan, Gas-based economy fuels cleaner growth, November 22, 2018: The Times of India

LPG and PNG can happily coexist. PNG is an affordable, safe and clean fuel for household kitchens, which also provides the convenience of uninterrupted supply. Besides, the government is utilising LPG saved through the PNG adoption in providing LPG coverage to disadvantaged households and in remote regions. Doubts have been raised in certain quarters about the wisdom in promoting CNG when BS-VI auto fuels will be introduced nationwide in April 2020 since the latter is considered as clean as CNG. Again, we are giving people a choice of clean fuels without favouring any one fuel or technology over another. Generally, CNG is cheaper than petrol or diesel. Also, there are mostly BS-IV or earlier vehicles on our roads which can’t really reap the full benefits of the cleaner BS-VI fuels.

Since April 2014, the number of CNG stations in the country has gone up by 79% to reach 1,450 as of September-end 2018. The growth in the number of domestic PNG connections has been even more impressive at 90% — from 24.72 lakhs to 47.09 lakhs — in the same period. In the Delhi-NCR region, IGL added over 1 lakh new PNG connections in a record seven months in 2018-19.

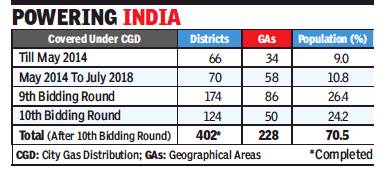

The 9th CGD bidding round was undertaken after extensive consultations with stakeholders, including state governments and CGD companies, and has proved to be a runaway success. After this round, CGD networks will cover 35% of the country’s area and 46.24% of its population. This round will attract about Rs 70,000 crore in investment.

Similarly, the 10th bidding round is expected to attract an investment of about Rs 50,000 crore. Cumulatively, after the implementation of the 10th bidding round, India will have CGD infrastructure operational in 228 GAs across 402 districts, serving over 70% of the population. India is looking at a robust infrastructure of about 10,000 CNG stations in 10 years from now. This will generate a new economy centred around CGD, and sets of employment opportunities will be created in about 400 districts in the country.

Expectedly, these developments in India’s CGD space have received a positive response from the industry. Several new companies, including from abroad, have entered the sector in recent years. The government has driven a firm message that CNG is a permanent auto-fuel. The response from leading auto-manufacturers has been encouraging and they are coming out with factory-fitted CNG vehicles.

While CNG can be a competitive fuel option for intra-city travel, we also see a bright future for LNG as a transportation fuel, especially for long-haul heavy commercial vehicles. Several companies are working on LNG trucking and LNG refuelling centres. Very soon, we will come across LNG refuelling stations on major industrial corridors in the country.

The government has been engaging stakeholders to address both supply and demand issues. Considerable progress has been made in extending natural gas access to eastern and north-eastern India through the Pradhan Mantri Urja Ganga pipeline and Indradhanush Gas Grid projects. LNG import infrastructure in the country will expand significantly in the near term with commercial operations of two new regas terminals at Mundra and Ennore slated to commence this fiscal. We expect gas supply in India to come not only from domestic fields and imported LNG but also from newer sources such as Bio-methane and Compressed Bio Gas (CBG). Oil marketing companies recently floated an ‘expression of interest’ with 100% offtake guarantee of CBG. The city gas infrastructure around more than 350 districts can receive CBG at any part of the country.

It is well known that the demand for natural gas in India is price-sensitive. The government is trying to increase gas consumption across diverse industries, especially MSMEs such as glass and ceramic units. Representatives of the steel industry have told us that gas-fired steel units are able to produce superior quality of steel. We are working on setting up India’s first-ever Gas Trading Exchange.

All of this, of course, will also promote employment for our youth. All stakeholders, but most importantly the companies, need to come forward to meet this challenge.

Imports

2013-18: imports and consumption

From: Sanjay Dutta, November 21, 2018: The Times of India

See graphic:

The import and consumption of natural gas in India: 2013-18

2018: India 2nd largest LPG importer

From: Sanjay Dutta, Pro-poor move makes India 2nd largest LPG importer, April 11, 2018: The Times of India

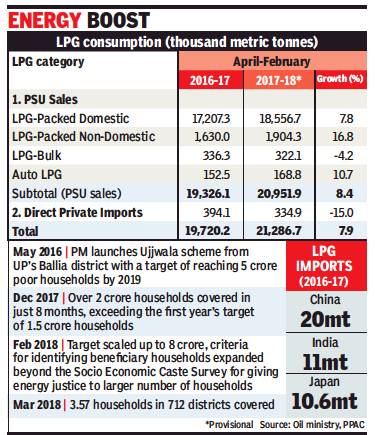

Demand Rises 8% In 2017-18; China At No. 1

India is the world’s second largest importer of LPG (liquefied petroleum gas) after China and remains ahead of Japan as the Modi government’s drive to provide clean cooking fuel to millions of poor families boosted household demand by nearly 8% in 2017-18.

The PM may flag the success of the Ujjwala scheme — one of his government’s flagship programmes aimed at delivering “energy justice” to the poor — to emphasise the potential of India’s energy market and need for an equitable global pricing regime when he addresses policymakers and oil industry captains at the 16th International Energy Forum ministerial here on Wednesday. The IEF is a 72-nation group accounting for 90% of global supply and demand for oil and gas.

India beat Japan in 2016 to become the world’s third-largest crude oil consumer after the US and China. Both International Energy Agency and Opec see India as the main driver of growth in global oil demand for the next decade.

Data indicates India’s imports of LPG in 2017-18 surpassing 11 million tonnes in 2016-17 on the back of Ujjwala adding volume to demand.

Only recently, international media reports quoting shipping data pegged India’s LPG imports at 2.4 million tonnes in December, exceeding China’s 2.3 million tonnes for the first time. But India still trails China’s average monthly import of 2.7 million tonnes with 1.7 million tonne.

While a monthly import spike may be caused by a variety of factors, the signs of consumption growth are, nevertheless, all there. Not surprising then that the rapid progress of the Ujjwala scheme under oil minister Dharmendra Pradhan’s watch, is estimated to push up household demand for LPG to more than 27 million tonne by 2022, up from more than 18 million tonne now.

Sources of import, 2004-18

Sanjay Dutta, India balances US ties with Russia gas deal, June 5, 2018: The Times of India

From: Sanjay Dutta, India balances US ties with Russia gas deal, June 5, 2018: The Times of India

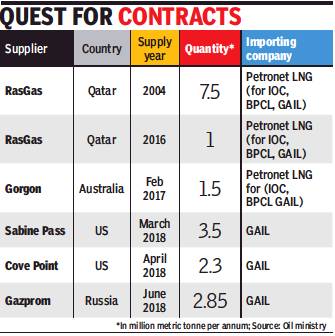

Country Gets Gas Supplies Under $25-Billion Agreement

India started receiving long-term gas supplies from Russia’s Gazprom, the world’s top publiclylisted natural gas company, under a $25-billion deal that indicates New Delhi’s quest for newer routes towards energy security and balancing ties with Washington and Moscow.

“Today will be remembered as a golden day for India’s energy security roadmap,” oil minister Dharmendra Pradhan said after receiving ‘LNG Kano’, the cryogenic ship carrying the first cargo of LNG (liquefied natural gas) under a 20-year deal with state-run GAIL.

Recalling Russia’s extended contribution in developing India’s oil and gas sector, Pradhan said the long-term gas supply establishes an energy bridge between the two countries as part of PM Modi and President Vladimir Putin’s plan for forging closer strategic economic cooperation.

Pradhan said India will import gas worth $1.5 billion a year under the deal signed by GAIL in 2012, a year after the state-run utility tied up long-term supplies from two US shale gas projects. All of India’s long-term gas deals are in operation, with Gazprom offering the most competitive terms.

Pradhan’s statement underlines an effort to put balm on Moscow’s growing unease over the Modi government’s growing closeness to Washington, especially in areas of defence and now energy. Indian refiners began importing small quantities of US crude last year. In April, GAIL received its first cargo of shale gas from mainland US. The beginning of Russian gas supplies will add to India’s bargaining power with its predominantly West Asian energy suppliers. .

LPG (liquefied petroleum gas)

India 2nd-biggest LPG user

Sanjay Dutta, At 19m tonnes|yr, India 2nd-largest LPG user in world, Feb 7, 2017: The Times of India

India has become the second-largest domestic LPG (liquefied petroleum gas) consumer in the world due to the Central government's rapid rollout of clean fuel plan for poor households and fuel subsidy reforms.

LPG consumption by households has reached 19 million tonnes, registering an annual growth rate of 10%.Consumption is expected to rise 20 million tonnes, backed by expanding consumer base in urban areas and rapid rollout of the `Ujjwala' scheme for providing LPG connections free of cost to five crore poor households by 2019.

The Ujjwala scheme has turned India into an example for energy experts from other emerging economies still struggling to provide clean fuel to their rural folks. No wonder the World LPG Association (WLPGA) -so far focused on developed economies -has chosen to hold its Asia summit in Delhi.

Barely nine months after being launched by the PM in May 2016, the scheme has covered 1.6 crore poor households, topping the target set for the entire 2016-17 financial year on the back of a massive rural outreach push. “It simply beats me how they achieved this,“ WLPGA Yagiz Eyuboglu told a curtain-raiser session on Monday in a compliment to oil minister Dharmendra Pradhan.

“When we assumed office, we had a system of misdirected subsidies, rich and uppermiddle class were entitled to LPG subsidies. There were many duplicate connections and the subsidized LPG was diverted to commercial and industrial segments. As a result poorest of the poor never had access to LPG. In 2014, almost half of Indian households didn't have LPG connections. We decided to change the LPG landscape in India,“ Pradhan said, giving an insight into the government's thinking behind the reforms.

Pradhan said reforms in the subsidy mechanism -elimination of ghost consumers and direct subsidy transfer -saved an estimated Rs 21,000 crore, or $3.2 billion, in the two years of the Modi government. During this time, he said, Rs 40,000 crore, or $6.5 billion, in subsidy has been transferred directly to bank accounts of consumers.

Direct benefit transfer: 2015, ‘16

Govt transfers Rs 40k cr to a|cs of LPG users, Feb 8, 2017: The Times of India

The government has transferred Rs 40,000 crore, or $6.5 billion, into bank accounts of household LPG consumers in the two years since it refreshed the cooking gas subsidy regime to plug leakages, according to oil minister Dharmendra Pradhan.

The weeding out of some 3.3 crore (33 million) ghost accounts as part of the reform process resulted in savings of Rs 21,000 crore, or $3.2 billion, in subsidy payout, which has helped the government to spend more on social sector projects and bring clean fuel to poor households.

As a pointer to the success of the reforms in the direct benefit transfer scheme for LPG DBTL, which is now known as PaHAL, Pradhan told the Asia LPG Summit curtain-raiser on Monday that sale of commercial LPG cylinders jumped nearly 40% in 2015-16 against a near-stagnant growth earlier.

Commercial cylinders are sold at market rate and used by shops and establishments such as hotels, restaurants and neighbourhood sweetmeat shops etc. Before the government took up the reforms, subsidised domestic cylinders were being diverted for commercial use. The government currently transfers Rs 184. 29 per cylinder as subsidy .

“Nearly 6.3 million new LPG connections have been released to poor families in 2015-16... We have set a target to provide 50 million LPG connections over a period of three years to poor households, with a budgetary support of Rs 8,000 crore,“ he said, adding that the 15 million target for 2016-17 was achieved in less than eight months.

“I am confident that we will exceed this target. We have already increased the national LPG coverage to 70 per cent and we may even reach 85 per cent in 2 years,“ he added.

The Modi government initiated a combination of steps to improve the subsidy delivery mechanism, beginning with elimination of bogus connections through an intensive customer verification drive.

Pradhan said DBTL was launched in 2014 wherein subsidy was directly paid into the bank accounts of the beneficiaries. “This made the process transparent and plugged the subsidy leakages which were otherwise being misused through ghost accounts.“

Natural gas (CNG, PNG)

City gas operators profiteer due to monopoly

Sanjay Dutta, City gas operators making windfall due to monopoly?, March 3, 2017: The Times of India

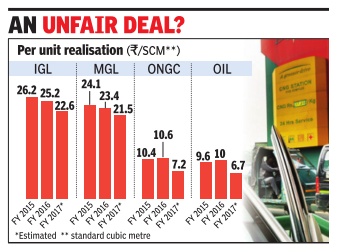

Cos Earn Even More Than Gas Producers

Are gas sellers making more than their fair share for CNG and PNG in the absence of competition in the market and differential regulatory frameworks? A look at the per unit realisation of two of the largest city gas distribution companies, Indraprastha Gas Ltd in Delhi and Mahanagar Gas Ltd in Mumbai, appears to suggest so. According to a report by Kotak Institutional Equities, monopoly situation and differential regulatory frame works allows city gas distribution firms to earn more than gas producers such as state-run ONGC and Oil India Ltd, who have to sink billions of dollars in risk capital for discovering and developing fields. Kotak Equities is a division of institutional brokers Kotak Securities.

Profitability of IGL and MGL has gone up over the past few quarters as they have been able to retain the benefits of the decline in price of domestic gas and “earn quite high RoAE (return on average equity) as their business es are not regulated,“ the Kotak report said. Other industry analysts said while the regulator allows a return of 12% on investments made by city gas distribution networks, their earning ranges between 18-20%. In contrast, AGLSouthern Company of the US earns 11.68% and UK's Centrica makes 12.9% on capital employed.

One of the main reasons for the high profitability of city gas distribution business is the monopoly situation. Both IGL and MGL do not have competition, nor do other firms where city gas projects are running. Norms allow market exclusivity for three years to a company that existed before the PNGRB Act came into being.In new projects, which are bid out, companies are given exclusivity for five years.

Pricing

Low pricing chokes gas discoveries; imports rise

Sanjay Dutta, November 21, 2018: The Times of India

India is losing out on a third of its current natural gas production due to inadequate pricing, even as the government’s drive to raise share of gas in the country’s energy basket is pushing up imports.

Announcements made from time-to-time by ONGC and OIL, indicate the two pillars of the country's hydrocarbons production could be sitting over discoveries that can supply 30 mcmd (million cubic meters per day) of gas. This is enough to generate 6,000 mega watt, roughly Delhi’s daily consumption, or run CNG and PNG services in six cities/ markets the size of Delhi-NCR But the companies can’t start production from these discoveries as they cannot recover costs in a market without pricing and marketing freedom. The current price of $3.36 per unit, set by the government, does not cover the cost to begin pumping, which needs at least $6.

India produces about 90 million cubic meters per day of gas and plans to double output by 2022 to reduce reliance on imports and reduce the economy’s carbon footprint.

Industry watchers said these discoveries can help the country reach its goal as they are on land, in shallow waters or in the periphery of existing fields and easier to bring into production quickly. In contrast, waiting for the big-ticket deep sea and ultra-deep sea discoveries to come on stream will cost $10 billion and time.

The problem lies with the pricing formula brought in by the government in October 2014, which offers higher price for gas produced from only difficult discoveries and does not cover the 30 mcmd reserves.

While the companies grapple with the conundrum, there is a renewed move in the government to strip them of 118 small producing discoveries – 113 of ONGC and 5 of OIL accounting for 10% of their output – for auctioning. Many of these operate through budget and infrastructure of larger fields and may not offer value proposition in isolation. Another concern is that wildcatters and small players have been known to damage reservoirs irretrievably in quest of making a quick buck.