External commercial borrowings: India

(→Unhedged exposures) |

(→YEAR-WISE TRENDS) |

||

| Line 9: | Line 9: | ||

| + | |||

| + | =Unhedged exposures= | ||

| + | ==2021-22== | ||

| + | [[File: Unhedged exposures of Indian companies, as at the end of 2021-22.jpg|Unhedged exposures of Indian companies, as at the end of 2021-22 <br/> From: [https://epaper.timesgroup.com/article-share?article=22_07_2022_017_005_cap_TOI July 22, 2022: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Unhedged exposures of Indian companies, as at the end of 2021-22 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|E | ||

| + | EXTERNAL COMMERCIAL BORROWINGS: INDIA]] | ||

| + | [[Category:India|E | ||

| + | EXTERNAL COMMERCIAL BORROWINGS: INDIA]] | ||

=YEAR-WISE TRENDS= | =YEAR-WISE TRENDS= | ||

| Line 29: | Line 42: | ||

[[Category:India|E EXTERNAL COMMERCIAL BORROWINGS: INDIA | [[Category:India|E EXTERNAL COMMERCIAL BORROWINGS: INDIA | ||

EXTERNAL COMMERCIAL BORROWINGS: INDIA]] | EXTERNAL COMMERCIAL BORROWINGS: INDIA]] | ||

| − | [[Category:Pages with broken file links|EXTERNAL COMMERCIAL BORROWINGS: INDIA]] | + | |

| + | [[Category:Economy-Industry-Resources|E EXTERNAL COMMERCIAL BORROWINGS: INDIAEXTERNAL COMMERCIAL BORROWINGS: INDIA | ||

| + | EXTERNAL COMMERCIAL BORROWINGS: INDIA]] | ||

| + | [[Category:India|E EXTERNAL COMMERCIAL BORROWINGS: INDIAEXTERNAL COMMERCIAL BORROWINGS: INDIA | ||

| + | EXTERNAL COMMERCIAL BORROWINGS: INDIA]] | ||

| + | [[Category:Pages with broken file links|EXTERNAL COMMERCIAL BORROWINGS: INDIA | ||

| + | EXTERNAL COMMERCIAL BORROWINGS: INDIA]] | ||

Latest revision as of 09:57, 15 May 2025

This is a collection of articles archived for the excellence of their content. |

Contents |

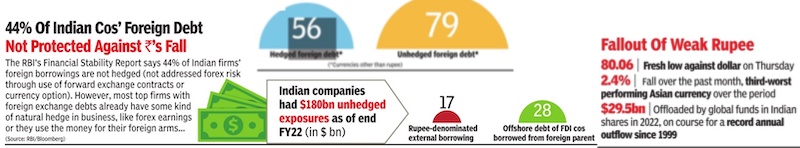

[edit] Unhedged exposures

[edit] 2021-22

From: July 22, 2022: The Times of India

See graphic:

Unhedged exposures of Indian companies, as at the end of 2021-22

[edit] YEAR-WISE TRENDS

[edit] 2018 Oct> 2019 Oct

India Inc’s foreign borrowings grew over two-fold to $3.4 billion in October over the corresponding month a year ago, according to RBI data. Indian companies had raised $1.4 billion in borrowings from overseas markets in October 2018.

Of the total money borrowed by domestic companies, $2.9 billion was through the automatic route of external commercial borrowing (ECB), $538 million came through the approval route of ECB, showed the data.

In the ECB category, the major borrowers tapping the automatic route included Muthoot Finance ($400 million), HPCLMittal Energy ($300 million), Wardha Solar (Maharashtra) ($251 million), L&T ($200 million), Deccan Fine Chemicals ($140 million) and Aditya Birla Finance ($75 million).

Two companies tapped the approval route with JSW Steel raising $400 million, while Shriram Transport Finance borrowed $138 million in October this year. No money was raised through the rupee-denominated bonds or the masala bonds during the month, nor in the year-ago period. AGENCIES