Reliance Industries Ltd.

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

Gas

KG-D6 Andhra offshore block/ field

Govt fines RIL $1.6bn for using ONGC gas

Govt fines RIL $1.6bn for using ONGC gas, Nov 05 2016 : The Times of India

Co Plans Arbitration, Says Demand Based On `Misreading Of Key Elements' Of PSC

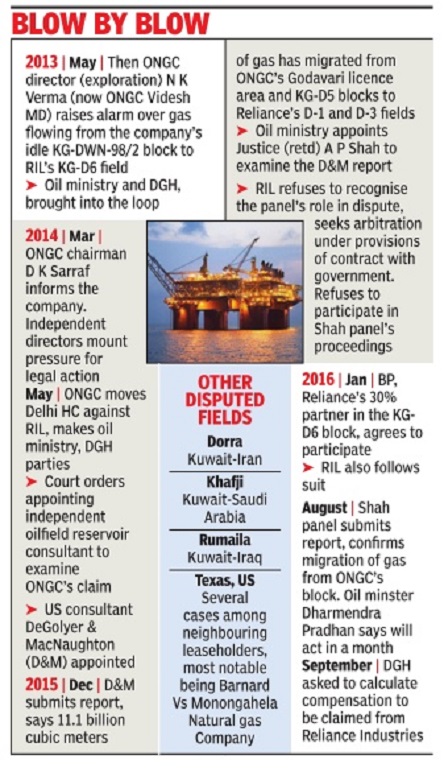

The stage has been set for another round of legal slugfest between India's biggest private sector oil company and the government, with the oil ministry asking Reliance Industries and its partners in the KG-D6 Andhra offshore Block to pay $1.55 billion (approximately Rs 10,000 crore based on current exchange rate) as cost of gas that migrated to their side from an adjacent block belonging to state-run ONGC.

RIL responded to the demand note, sent on Thursday to it, British major BP and Canadian explorer Niko, by saying it proposed to initiate arbitration since the demand was based on “misreading and misinterpretation of key elements of the PSC (production sharing contract) and is without precedent in the oil and gas industry anywhere in the world“. “RIL proposes to invoke the dispute resolution mechanism in the PSC and issue a Notice of Arbitration to the government. RIL remains convinced of being able to fully justify and vindicate its position that the government's claim is not sustainable,“ the company said in a statement.

“According to the government, the Contractor is restricted to producing only that quantity of hydrocarbon as they existed at the point in time when the PSC was signed.This approach overlooks the fundamental fact that at that stage the work of exploration of the block has not even commenced and a complete lack of data makes it impossible to estimate the quantity of hydrocarbons available in the block.“ “The liability of the contractor has not been established by any process known to law and the quantification of the purported claim is without any basis and arbitrary .“

RIL and the government are already engaged in several international arbitrations with more than $5 billion at stake. The arbitrations have been initiated on issues ranging from penalty imposed for failure to meet the promised output targets and gas pricing in KG-D6 to cost calculations in the Panna-Mukta and Tapti fields, which have now been abandoned.

The ministry has deman ded $1.47 billion for 338.332 million units (measured in British thermal unit) of gas that migrated from ONGC's field in seven years ended March 2016. From this amount, $71.71million royalty that RIL paid on this gas was demanded. But an interest of $149.86 million, charged at the rate of 2% above Libor, was added to the amount to work out the total demand. The ministry also demanded $177 million in profit petroleum (government's share of profit) from the partners after disallowing certain costs previously as a penalty for RIL's failure to meet output targets.

The demand note follows the direction set by the panel the ministry had constituted under retired Justice A P Shah to adjudicate the report by US-based reservoir experts, DeGolyer and MacNaugton, appointed at the behest of the Delhi High Court. The report had confirmed ONGC's claim on migration of gas from its idle field into RIL's block, which started production in 2009.

The Shah panel upheld the report and said RIL and its partners had derived “undue enrichment“ from gas migrating from ONGC's block. It also said the compensation should go to the government since it is the public trustee of all natural resources. This is a sore point with ONGC since it was the original claimant for compensation -and some industry watchers said rightfully so -and had moved the court against RIL to pay up.

“The committee has concluded that the contractor's (RILBP-Niko) production of migrated gas and retention of ensuing benefits amounts to unjust enrichment, since the production sharing contract (PSC)... does not permit a contractor to produce and sell migrated gas,“ the demand note said.

Oil-to-chemicals (O2C) operations

2021: transferred to wholly owned subsidiary

Reeba Zachariah, February 24, 2021: The Times of India

From: Reeba Zachariah, February 24, 2021: The Times of India

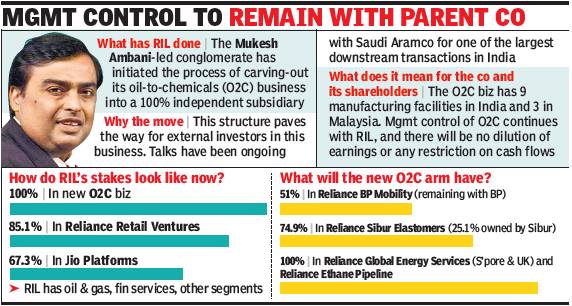

Reliance Industries (RIL) will transfer its oil-tochemicals (O2C) operations to a wholly owned subsidiary for a $25-billion loan, besides $12-billion equity. Consideration for the transfer of the O2C assets, which includes the operating team and 12 manufacturing facilities, will be funded by a $25-billion loan from the parent, the company said in a presentation filed with the stock exchanges.

The interest-bearing loan from RIL to the O2C company will be an “efficient mechanism to upstream cash, including any potential capital receipts in the unit”, it said. Carving out the O2C operations into an independent entity will make it easier for RIL to bring in external investors. It had earlier explored a different structure, but India’s securities market rules did not permit such a scheme.

RIL had said earlier that it, being a listed company, cannot issue shares with differential rights (that is, equity shares with interest linked only to the O2C business) to investors. Therefore, the O2C undertaking has to be transferred into a wholly owned subsidiary of RIL, in which the external investors will invest, it had said.

RIL has been in discussions with Saudi Aramco to sell a 20% stake in the O2C unit for more than one and a half years. The deal, if successful, could lead to further deleveraging of RIL. RIL will retain management control of the O2C company. The separation will also not dilute earnings or restrict cash flows for the parent, according to the company’s presentation. The O2C transfer on a slump sale basis — subject to courts, shareholders and creditors approvals — is expected to be concluded before September 30. Slump sale means transfer of an undertaking for a lump sum consideration without values being assigned to individual assets and liabilities.

“The income tax law lays down specific computation provisions for a transaction qualifying as a slump sale. This computation mechanism remains the same, irrespective of such transaction carried out through an NCLT scheme or through a private arrangement. Basis of this mechanism, the seller is allowed to offset its tax net worth as on the transfer date from the aggregate sale consideration. If the sale consideration of the transaction equates to or is less than the tax net worth of the transferred undertaking, then no capital gains or associated tax liability would arise. Also, such slump sale transaction entailing the transfer of undertaking as a going concern would not entail GST implications,” said RBSA Advisors MD Ravi Mehta on the Reliance O2C demerger.

Market capitalisation

2019 Nov: RIL’s m-cap is ₹10-lakh-crore, first Indian co

Nov 30, 2019: The Times of India

The growth of Reliance Industries (RIL), 2005-2017.

From: Nov 30, 2019: The Times of India

Homegrown global petrochemicals major Reliance Industries (RIL) on Thursday became the first Indian company to touch the Rs 10-lakh-crore market capitalisation level. This marks the doubling of its value in less than two and half years, and comes just over three years after its strong but controversial entry into the country’s telecom services business. During the day, the RIL stock on the BSE rallied to an all-time high of Rs 1,584 and closed at Rs 1,580, which translated into a market cap of Rs 10.01 lakh crore, BSE data showed.

Started as a polyester manufacturer in the early 1960s by its founder Dhirubhai Ambani, RIL grew during the first 40 years through forward and backward integrations, like setting up refineries and petrochemicals production facilities. It then went into oil explorations. In the early 2000s, it had entered the telecom services space and, in early 2010s, the consumer retail space. Through various subsidiaries, it also has a presence in areas like media, life sciences, infrastructure and logistics.

The promoters, led by billionaire Mukesh Ambani, hold a little over 50% in the company and the balance is held by institutional and public shareholders. With nearly 23 lakh shareholders, RIL is the most widely held company in India. Boosted by his majority stake in RIL, CMD Ambani is now the richest man in Asia with a net worth of nearly $61 billion.

In the last six months, the stock has rallied 20% after RIL recently set an 18-month target to turn itself into a zero-debt company. The recent rally was also boosted by the decision by Reliance Jio, the company’s telecom services arm, to hike telecom tariffs, which is expected to increase its average revenue per user (ARPU). This, in turn, would add to its revenues.

Among the Indian companies, software exports major TCS, with a market cap of Rs 7.8 lakh crore is behind RIL, with HDFC Bank (Rs 6.9 lakh crore), HUL (Rs 4.5 lakh crore) and HDFC (Rs 4 lakh crore) making up the top five slots in terms of most valuable companies.

Profits: 2015-16

The Times of India, April 23, 2016

RIL posts biggest quarterly profit in 8 years at Rs 7,398cr

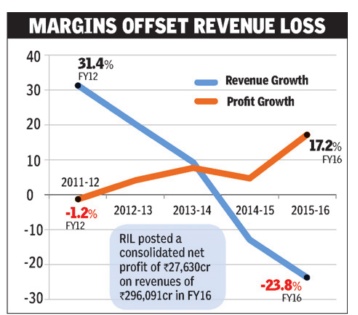

Reliance Industries' (RIL) fourth quarter (Q4FY16) consolidated profit rose nearly 16% to Rs 7,398 crore ($1.1 billion), the highest in more than eight years, due to strong margins in its refining and petrochemicals business. The company's refineries earned $10.8 on each barrel of crude processed as against $10 a year earlier. RIL's earnings beat analyst estimates of Rs 7,010 crore, according to Bloomberg.

RIL's Q4FY16 revenues declined nearly 9% to Rs 64,569 crore ($9.7 billion) as the benchmark (Brent crude) oil prices declined 41% in the last one year. Exports fell about 18% to Rs 30,935 crore due to lower product prices.

The revenues from the company's mainstay -refining and marketing -decreased 15% to Rs 48,064 crore, but gross profit from this segment increased 30% to Rs 6,394 crore. This segment accounted for 74% of RIL's revenue and 67% of its gross profit in the quar ter ended March 2016.

Petrochemicals, the second biggest contributor to revenues, declined 4% to Rs 20,915 crore in the fourth quarter from a year earlier but gross profit increased 35% to Rs 2,713 crore. This segment accounted for 32% of the company's revenue and 28% of its gross profit in the three months ended March 2016.

For fiscal 2016, RIL's consolidated profit climbed 17% to Rs 27,630 crore while revenue rose 24% to Rs 296,091 crore.Gross profit from refining increased 49% to Rs 23,598 crore and that of petrochemicals enhanced 23% to Rs 10,221crore. “FY16 has been a year of outstanding achievement for our downstream hydrocarbon businesses. Our refineries sustained double-digit gross refining margins and record levels of utilization through the year. Our balanced petrochemical portfolio, across products and feedstocks, helped capture the benefit of vastly improved naphtha cracking economics and favourable polymer markets,“ said Mukesh Ambani, CMD, RIL, which operates the world's biggest oil refinery complex in Jamnagar, Gujarat, in a statement.

Higher profits will help the company complete its expansion projects in its petrochemicals and refining business at Jamnagar, Dahej and Hazira and start its mobile service operations. Ambani said RIL's telecom subsidiary Reliance Jio Infocomm will commercially roll out its 4G services this year. Reliance Jio has so far spent Rs 1.2 lakh crore, including on spectrum, and will spend another Rs 30,000 crore in building the telecommunication business.

Vimal

RIL selling 49% in ‘Vimal’ to Chinese textile company

Piyush Pandey, December 10, 2014

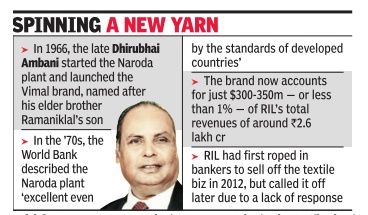

Through the late 1970s and early 1980s, the distinctive tune of ‘Only Vimal’ ads became instantly recognizable to millions of Indians.

From top models to Bollywood hearthrobs and cricket stars, they all featured in the iconic ads. As the clothing brand went from strength to strength, so did its owner—an initially obscure company founded by Dhirubhai Ambani called Reliance Textiles that was in 1985 rechristened Reliance Industries Ltd.

While nostalgia may be a powerful factor, savvy tycoons don't allow it to overcome business sense. Which is why RIL, India's biggest company now led by Mukesh Ambani, has decided to sell a 49% stake in the textiles business to the $3-billion Chinese textile giant Shandong Ruyi Science & Technology Group for an undisclosed sum. RIL will hold 51% in the new JV. The textile business is located at Naroda near Ahmedabad and was set up in 1966. But it now contributes $300-350 million, or less than 1%, to the overall $65-billion annual revenues of RIL. In 2012, RIL had appointed bankers to sell its textile business but the sale was called off due to a tepid market and lack of buyers.

“Our joint venture with Ruyi Group will help Reliance reposition its textile business on a high-growth path,” said Nikhil R Meswani, executive director, RIL. Ruyi, a leading textile company in China, has a global presence, including in America, Europe, Japan, Australia, New Zealand and China. It has a portfolio of world-renowned brands such as ‘Taylor & Lodge’, ‘Harris Tweed’, ‘Royal Ruyi China’, ‘Nogara Italy’ and ‘Indios Italy’. Ruyi also operates in India under the ‘Georgia Gullini’ brand in the worsted suiting segment of the market. This business operation and its other activities would get realigned to strengthen the JV.

Investment adviser S P Tulsian believes that the deal size would not be significant, given that none of the textile companies in that space is valued at over $100 million.