Venture Capital Funding: India

This is a collection of articles archived for the excellence of their content. |

2014

Shilpa Phadnis

Jan 22 2015

India among world's top 3 VC destinations

India received the third highest venture capital funding ($4.6 billion) in the world in 2014, after US ($58.9 billion) and China ($8.9 billion). Bengaluru was fifth in a list of cities globally, an indication of the growing vibrancy of its startup ecosystem. San Francisco, one of three American cities in the top 5, led the list with $13 billion of VC investments, followed by Beijing ($6.4 billion), New York ($5.7 billion), Palo Alto ($3.2 billion) and Bengaluru ($2.6 billion). The list has been put together by Crunchbase, a global startup ecosystem database. Ravi Gururaj, chairman of the Nasscom Product Council, said India enjoyed a record crop of VC investments in the second half of 2014 and the wave was showing no sign of slowing down.

“This was kicked off by the historic election results which boosted investor confidence tremendously ,“ Gururaj said. “Additionally, private equity investors worldwide, particularly those that missed out on the meteoric rise in Chinese startup valuations, flocked to high performing Indian consumer startups determined not to miss out on a fast ride on the `India Startup Express'.“ Sanjeev Aggarwal, cofounder of Helion Ven ture Partners, said Bengaluru's lead position was because of its ability to attract tech talent. “The virtuous cycle kicked in with Infosys and Wipro, followed by global captives coming in large numbers.Engineers employed with companies like Google and Yahoo wanted to experiment with new ideas, and that has spawned a startup culture. Mobile apps and cloud have reduced entry barriers to build companies,“ he said. CrunchBase does not give a breakup of the investments in each city. In Bengaluru's case, a significant portion of the $2.6 billion would likely be on account of Flipkart's two rounds of funding that happened last year. The e-commerce company received an estimated $1.7 billion.

Parag Dhol, managing director of Inventus Advisors India, believes Bengaluru's startup ecosystem is beginning to have a multiplier effect. “You have an ecosystem where companies have gone public, there are good product startups, and new age entrepreneurs are turning into angels. In that sense, success begets success.Venture capitalists are looking at India with a fresh set of eyes,“ he saidAggarwal noted that capital was going particularly to the leaders who are building companies in large underserved markets, companies like Flipkart, Snapdeal and Ola. “Investors are paying a leadership premium,“ he said. Japanese internet giant Softbank invested $627 million in Snapdeal and $210 million in Ola Cabs in 2014.

India vs China: first quarter of 2015

The Times of India, May 02 2015

Anand J & Shilpa Phadnis

But dragon still dominates in total funding

India tops China in No. of tech VC deals

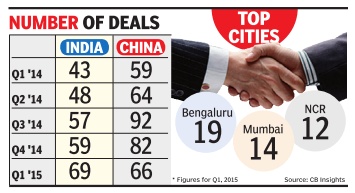

In a sign of the rising opportunities in India, the country outpaced China in the number of deals struck by venture capital (VC) funds in the first quarter of 2015. India saw 69 deals happening in the first quarter as against China's 66, according to a report by CB Insights, a New York-based firm that tracks VC funding. India saw the most deal growth among Asian countries, at 60% compared to the first quarter of 2014, when the number of deals stood at 43.

China was still ahead of India in terms of deal value at $2.99 billion. India's funding stood at $1.35 billion. For India, this was a rise of 225% over the same quarter of the previous year. Both countries reported a drop in the quantum of money raised from the last quarter of 2014. Japan saw 28 startup deals by VCs during the first quarter.Overall the top 3 countries in Asia accounted for 66% of all deals to VC-backed tech companies in Asia in Q1 of 2015.

Sunil Rao, country head of the startup programme in Google India, said India is on the same trajectory that China was in 2007-08 with respect to the number of startups emerging from the country and the number of internet users. “The country will reach 500 million nternet users in two-three years and the gap won't be much now . Even the GDP growth rates are around the ame levels,“ he noted.

According to the CB Insights, Chinese startups consti uted 12 of the top 15 startup deals in Asia while India star ups constituted the rest. For he first time, India has raised more than $1 billion for three consecutive quarters. Rao said China would continue to see arger valuations as it is a much arger market.

Mohan Kumar, partner, Norwest Venture Partners, said one quarter is too early to say anything about a trend. “Hav ng said that, China has recorded $3 billion in annual investment in the last five years.There are a few positives on he Indian side with the economy picking up steam. If we can eplicate China's growth in the last decade by growing at 10%, the catch-up could be possible in a few years. We have to give it 3-4 quarters before saying India is beginning to outshine China,“ he said.

Sequoia Capital was the most active investor in India in the quarter, the CB Insights report said. The VC firm participated in three of the six largest deals of the quarter FreeCharge, CarDekho, and NewsHunt. Tiger Global Management was the second most active investor, with multiple early-stage deals to companies including Grofers, News in Shorts, and MoonFrog Labs.“After a big Q4 2014 which featured six $500-million plus rounds, Asian VC-backed tech companies came slightly back down to earth, raising $4.8 billion on 247 deals. The funding total is still the second highest total since 2013, up 95% versus the same quarter a year prior,“ the report said.

Mumbai and NCR ahead of Bangalore

The Times of India, Jul 10 2015

Anand J

Mumbai, NCR beat B'luru in VC funding

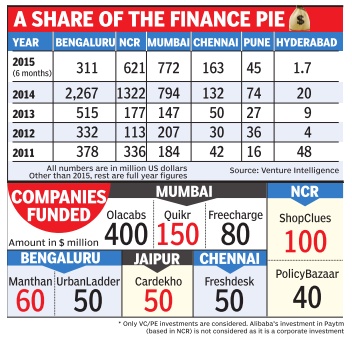

For the first time since 2011, Bengaluru has been surpassed by both the national capital region (NCR) and Mumbai in attracting venture capital (VC) funding. Data for the first six months of the year compiled by Venture Intelligence, a firm that tracks funding, finds that Bengaluru attracted $311 million in VC funds, while Mumbai received $772 million and NCR $621 million. The second half of the year tends to attract more VC funding, and a few big rounds could change this order. But the interesting thing is that Mumbai has received in the six months of this year as much funding as in the whole of last year, and Chennai has already received much more.

“Most big ecosystems have multiple hubs,“ said Rajesh Sawhney , founder and CEO, GSF Accelerator. While the US has strong centres like New York, Boston, Austin, Seattle and Atlanta, besides Silicon Valley, China has Shanghai, Beijing and Shenzhen, he said. The data is based on the cities that companies are registered in. Ola and Quikr are registered in Mumbai, but have moved their headquarters to Bengaluru. The two ventures were the biggest fund raisers in the first half, with Ola raising $400 million and Quikr raising $150 million. If headquarters and where the CEO sits are taken as the basis for the data, Bengaluru still remains on top.

NCR has been a big base for multinational companies, and its big consumer market has created large consumer internet companies like Snapdeal, Paytm and Zomato. “NCR has a good balance, with talent that has good IT product experience, and the city is not expensive like Mumbai. Apart from the Powai area near Mumbai, it is difficult to find hardcore technology talent in Mumbai,“ said T C Meenakshisundaram, founder and MD of IDG Ven tures, a venture capital firm.

Snapdeal opened a technology centre in Bengaluru this year. “At scale, companies will find even NCR to be talentcrunched. You won't find Bengaluru firms opening technology centres in NCR,“ said Meenakshisundaram, adding that Bengaluru will remain the Silicon Valley of India. Last year, the amount Bengaluru attracted was almost double that of NCR and thrice that of Mumbai. Chennai, Pune and Hyderabad were the other cities that attracted sizeable VC funds, but were almost one-fifth or onesixth for most years from 2011.

Pranay Chulet, CEO and co-founder, Quikr, an online classifieds portal that is valued at more than a billion dollars and which moved to Bengaluru six months ago, said, “Moving to Bengaluru was the right thing to do, and that is blindingly clear to us now.“